Construction Accounting: Navigating Taxes and Expenses in the Construction Sector

Construction Accounting: Navigating Taxes and Expenses in the Construction Sector

Blog Article

Secret Solutions Offered in Building And Construction Bookkeeping to Boost Financial Oversight

In the world of building and construction accountancy, essential solutions such as job cost estimate, budget plan monitoring, and money flow evaluation play a crucial role in boosting monetary oversight. Comprehending these subtleties can significantly affect the effectiveness of economic oversight in building projects.

Project Cost Estimation

Effective task cost estimation is a critical element of effective building audit solutions, as it straight affects budgeting and monetary planning (construction accounting). Accurate expense estimates provide an extensive overview of the monetary needs for a building job, making it possible for stakeholders to make educated choices relating to resource appropriation and task usefulness

A detailed cost estimate process encompasses different components, including labor, materials, tools, overhead, and contingencies. By assessing historical information and existing market fads, building and construction accountants can develop sensible price quotes that mirror real job prices. This analytical approach not just aids in safeguarding funding but likewise boosts transparency and accountability amongst all events involved.

Furthermore, specific cost estimation functions as a foundation for surveillance and regulating expenditures throughout the task's lifecycle. By developing a clear baseline, construction accountants can determine inconsistencies between estimated and actual expenses, allowing for timely changes and treatments.

Eventually, efficient job cost estimation not just facilitates smoother project execution yet also strengthens the general monetary health of construction companies, ensuring they continue to be competitive in a significantly vibrant industry. This critical method highlights the significance of competent specialists in providing reliable and precise cost estimates.

Spending Plan Management

In the realm of construction bookkeeping services, budget administration plays a pivotal role in making sure that projects remain economically feasible and on course. Reliable budget monitoring includes the methodical preparation, surveillance, and controlling of task expenses to line up with financial goals. It begins with the creation of an in-depth spending plan that precisely mirrors the expected costs of labor, products, equipment, and overhead based on thorough job price estimation.

When the budget is established, recurring surveillance is essential. This includes routine assessments of actual expenses versus the allocated numbers, enabling for prompt identification of disparities. By implementing devices and software customized for construction accounting, task managers can generate real-time reports that facilitate notified decision-making.

In addition, aggressive spending plan administration makes it possible for stakeholders to adjust monetary allowances and sources as essential, promoting versatility in action to unexpected challenges. This adaptability is critical in the building market, where job ranges can often change. Eventually, robust budget administration not just reinforces monetary liability but likewise boosts general task efficiency, making certain effective conclusion within the allocated monetary specifications.

Money Circulation Evaluation

Capital evaluation acts as a critical element of construction accounting, enabling task managers to keep a clear understanding of the inflow and discharge of funds throughout the job lifecycle. This logical process enables the recognition of prospective cash lacks or excess, empowering managers to make informed choices concerning budgeting and source allocation.

By thoroughly tracking cash inflows from customer settlements, lendings, and other profits sources, together with keeping an eye on discharges such as labor, materials, and overhead costs, task supervisors can develop a comprehensive cash circulation estimate - construction accounting. This estimate not only help in forecasting future monetary placements yet also assists in determining trends that might affect project practicality

Routine capital analysis helps with prompt interventions, allowing job supervisors to deal with economic challenges before they rise. This positive technique can reduce threats related to postponed repayments or unexpected costs, inevitably resulting in even more successful project completions. Furthermore, efficient capital monitoring contributes to keeping solid connections with subcontractors and vendors by making sure timely repayments.

Basically, money circulation analysis is an essential tool in building accountancy, driving monetary stability and functional efficiency throughout the duration of construction tasks.

Regulatory Compliance Support

Regulative compliance assistance is important for construction firms navigating the complex landscape of market regulations and standards. The building and construction sector is subject to a myriad of neighborhood, state, and federal regulations, including security requirements, labor laws, and ecological guidelines. Non-compliance can lead to considerable penalties, delays, and reputational damages.

A robust conformity support system assists firms stay educated about relevant regulations and makes sure that they execute essential plans and procedures. This includes monitoring changes in regulations, providing training for staff members, and performing routine audits to assess conformity levels. Construction accountants play a crucial function in this process, providing knowledge to translate regulations and straighten economic methods appropriately.

Additionally, governing conformity assistance encompasses the preparation and submission of needed documentation, such as tax filings and reporting for labor standards. By developing an aggressive conformity approach, construction companies can mitigate dangers related to non-compliance, boost operational effectiveness, and cultivate a society of liability.

Ultimately, reliable regulative compliance support not just safeguards a construction company's financial health yet also reinforces its reputation in the market, positioning it for lasting growth and success.

Financial Coverage and Insights

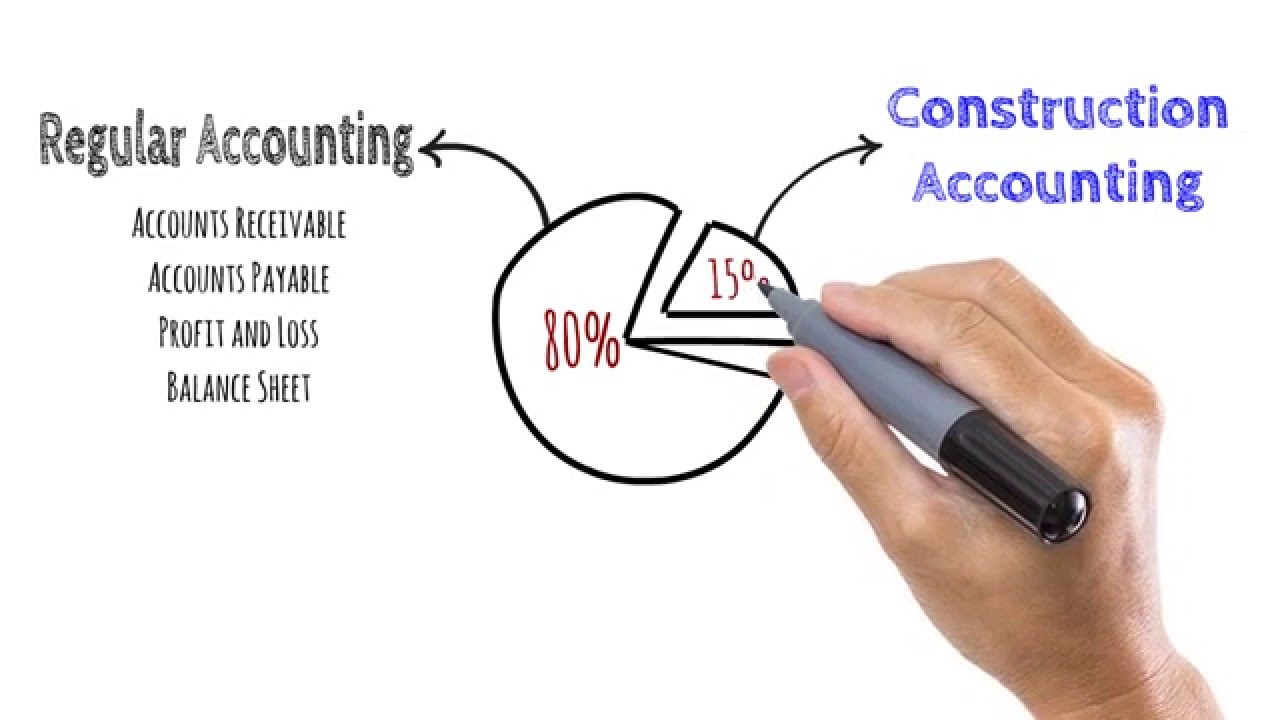

While navigating the complexities of the construction sector, exact economic reporting and insightful analysis are important for notified decision-making. Building and construction see this here tasks often include considerable resources investment and varying prices, making it crucial for stakeholders to have accessibility to timely and clear economic information. Thorough financial records, including revenue and loss declarations, cash circulation forecasts, and equilibrium sheets, offer a snapshot of a company's monetary health and wellness and performance.

Furthermore, customized understandings obtained from these reports help supervisors identify patterns, assess project productivity, and make calculated modifications to boost operational performance. Trick efficiency indications (KPIs) certain to building and construction-- such as task margins, labor expenses, and overhanging ratios-- use valuable benchmarks for evaluating success and forecasting future performance.

Additionally, regular economic coverage enables conformity with legal commitments and promotes transparency with capitalists and stakeholders. By leveraging advanced bookkeeping software program and information analytics, building firms can boost their economic oversight, allowing them to browse uncertainties better. Ultimately, durable monetary coverage check this site out and actionable understandings encourage building and construction companies to make educated choices that advertise growth and sustainability in a highly affordable market.

Final Thought

In the world of building bookkeeping, crucial services such as project price estimate, budget plan administration, and cash money flow analysis play an essential role in boosting monetary oversight. Inevitably, robust budget plan monitoring not only bolsters monetary liability however also enhances overall task performance, making certain successful conclusion within the assigned economic parameters.

Report this page